Whether you are a small or medium sized company, a multinational, a brand new start-up or an established business, our objective is to help you manage your business efficiently and effectively, and with the assurance of strict confidentiality at all times. Our accounting and payroll outsourcing services team will tailor its work to your specific needs, allowing you to focus on your core business without the headache of staying on top of internal and statutory deadlines.

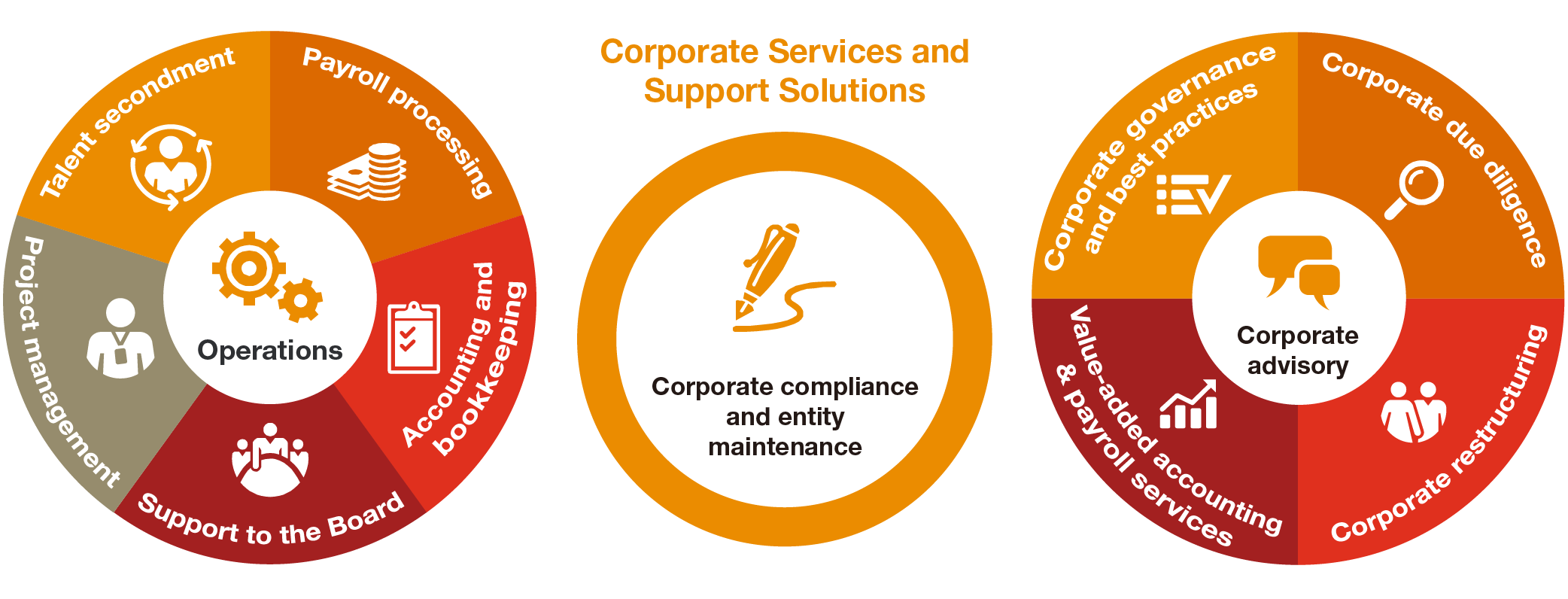

How we can help

- Accounting services

- Payroll services

- Company secretarial services

- Project management

- New A&P Value-added products

Accounting services

Regular services

- Assistance in the initial set-up of the full set of accounting books and records system (chart of accounts, accounting policy, software, etc.);

- Monthly accounting and bookkeeping services;

- Compilation of management accounts;

- Preparation of annual financial statements;

- Annual audit assistance (not the auditor, but a role of providing audit required documents and support); and

- Registration of accounting system with the in-charge finance bureau.

Special projects

- Accounting review and advisory services;

- Accounting reconciliation service (e.g. mapping between global and local financial systems, inter-company AR/AP reconciliation);

- Issuance of VAT/BT invoices; 4. Secondment services (e.g. Finance Manager, Accountant, Cashier);

- Co-sourcing services (working with the client’s team in order to complete a series of tasks);

- Cashier management services (e.g. AR collection control, AP management, loan application);

- Setting up financial data pool that can enable the extraction of necessary data in a short period of time to generate the outputs which can fulfill both internal and external requirements;

- Account review and reorganisation for pre-IPO or deal preparation;

- Liquidation financial support; and

- GAAP conversion services (e.g. conversion between Chinese Accounting Standards and IFRS).

Payroll services

Regular services

- Initial set-up of the payroll system;

- Payroll calculation and net salary payment arrangement;

- Payroll report for local accounting entry and HQ management;

- Preparation and filing of employees’ PRC Individual Income Tax returns and assistance in settling any related tax liability;

- Assistance in the employer registration of social benefits and housing fund;

- Monthly compliance work for social benefits and housing fund;

- Annual assessment for local employees' statutory social benefits and housing fund contribution;

- Assistance with external audits and inspection by social benefit authorities;

- e-Pay solutions (personal website to distribute individual payslips and other personal pay items); and

- Trust account services (settle payroll, social benefits and housing fund contributions, and PRC IIT through our trust account).

Special projects

- Payroll compliance review, including payroll calculation, IIT compliance and efficiency, compliance status of social welfare contribution, etc.;

- Payroll/HR secondment services;

- Payroll structuring and arrival meeting services;

- Advice on payroll and secondment arrangement for expatriates; and

- Employee leave management.

Company secretarial services

- Assistance in corporate set-up and annual inspection/report;

- Custody of client’s assets (e.g. various seals, checks and other bank slips);

- Update/alteration of the registration certificates;

- Preparation and submission of liquidation documents.

Project management

- Acting as coordinator and project manager for various functions of the back office;

- Ensure that the project timeline is properly followed and manage delay and unexpected circumstances; and

- Bringing in best practices from other similar projects and other resources if needed.

New A&P Value-added products

Overseas Accounting Services

More enterprises, including domestic enterprises, start paying attention and using outsourcing services. Accounting service is the core of the outsourcing services. Outsourcing services would not only help the management to focus on core business but also allow the management has a better control of the financial information, ease administrative burden and manage compliance risk.

This topic is more critical for enterprises doing business abroad. Professional outsourcing services would help the local entity fulfil the local compliance requirements. Our accounting outsourcing services comprise of initial accounting set-up, recurring bookkeeping, annual financial statements and annual audit assistance. We also provide integrated advisory services for accounting issues such as GAAP conversion, integration of accounting software etc. Outsourcing services would strongly support the management to manage the local entity.

PwC has leveraged its global network and built a dedicated team with specialised expertise in different countries - our Outsourcing Service team, to provide accounting services to our domestic enterprises. PwC China will take the role of coordination team. We also have GAAP expert to deliver the value added accounting advisory services.

Set-up of Financial System in China

MNCs normally would like to use the global ERP and financial system in China for easy data access and better internal control. However, there are a lot of compliance requirements in China. They may encounter various difficulties during system localisation. We have rich experiences on set-up of financial system in China and our services include but not limited to:

- Advising China local requirements for accounting and financial reporting;

- Preparing mapping between PRC and global chart of accounts;

- Reviewing the P2P, O2C, R2R work flow and providing comments/suggestions based on Company's policy as well as China's specific requirements;

- Documenting certain China unique processes;

- Assisting in various testing before system is on-line;

- Assisting in data uploading and conversion if local accounting software is needed for PRC financial and tax reporting purposes.

Annual GAAP conversion to Chinese Accounting Standards ("CAS")

Some MNCs adopt the accounting data under headquarters' GAAP for Chinese entities' local statutory and tax reporting. This approach is not fully in compliance with PRC requirements. Especially, when preparing annual statutory financial statement ("SFS"), these MNCs may be requested by the local auditor to convert the accounts from headquarters' GAAP to CAS before the auditor can start the audit work.

Given the above, we could assist our clients in converting the accounts from the headquarters' GAAP to CAS and preparation of annual SFS under CAS, including:

- Reviewing the transactions generated by client's ERP system under headquarters' GAAP and identifying the discrepancy against CAS;

- Setting out proposed GAAP adjustment entries;

- Preparing adjusted trial balance;

- Preparing financial statements with the foot notes based on the adjusted trial balance;

- Discussing the adjustments with the local auditor, if required.

Accounting Review and Reorganisation

Our client may encounter the following issues and need our accounting review and reorganisation services:

- During the initial set-up stage, the management are mainly engaged in the business development, and back office management is relatively week.

- For attracting venture capital or for IPO readiness, Company needs the well established accounting, payroll and tax system which can generate information to be reviewed by investor, auditor, bank, etc. at any time.

- With the expansion of production capacity and new business, volume and complexity of the financial information will be increased accordingly.

- Management cannot obtain the correct financial data timely due to ineffective communication with finance personnel. Meanwhile, there is lack of financial analysis capability and effective guidance on the business.

Our services include:

- Accounting review

- Interviewing finance and other relevant personnel to understand business and finance process;

- Reviewing the compliance status of existing accounting policy and financial procedure;

- Providing recommendations on the accounting policy and financial procedure by taking the best industry practice into consideration.

- Accounting review and reorganisation

- Reviewing vouchers, ledgers and financial statements, etc.;

- Reviewing compliance status of accounting treatment;

- Advising on the correct accounting treatment and adjustment entries;

- Assisting in posting of the adjustment entries, preparation of the adjusted financial statements and reorganisation of the accounting files;

- Reviewing the set-up and implementation status of the financial system / modules and providing advices on the improvement;

- Recommending and assisting in installation of the appropriate ERP system and modules;

- Assisting in preparation of the financial information for investigation purpose (e.g. investor, auditor, bank, etc.);

- Setting-up accounting data pool with accuracy and flexibility which can enable the extraction of accounting data in a short period of time to generate the output fulfilling both internal and external requirements.

Financial Re-engineering

PwC offers the Business Process Outsourcing ("BPO") services that can help our clients build the business infrastructure and the data pools in China on a swift basis. Essentially, the data pools comprise of financial data pool and payroll data pool, that can enable the extraction of necessary data in a short period of time to generate the outputs which can fulfil both internal and external requirements.

In addition, we are able to push the data classification requirements to the transaction levels and hence would mitigate the period end compliance pressure and resources deployment. We would also take the best practice of the industry into consideration and hence would save unnecessary time for creating the same tasks in China.

Refining the chart of accounts is a good example of financial re-engineering. We can set up or reclassify the accounts based on various output requirements including but not limited to group reporting, reconciliation with global accounts, tax reporting and other statutory reporting. Especially for annual Corporate Income Tax filing, the tax adjustments could be easily achieved provided there are separate account/indication specifically designed for tax purpose.

Payroll Solution for Outbound Domestic Enterprises

With the quicker and deeper implementation of “Go-Out” strategy, more and more domestic enterprises are sending outbound employees to develop their business overseas. Those domestic enterprises may face a lot of challenges in terms of payroll management for their overseas entities. Outbound payroll management requires HR personnel pay more attention to efficient payroll arrangement, consistent overseas secondment policy, incentive policy, and host countries' compliance requirements, etc.

Together with many domestic enterprises, PwC may help in the following ways, leveraging its global network where necessary:

- Provide complete payroll arrangement for outbound employees, including social benefits arrangement, payroll disbursement, foreign currency payroll remittance, etc.;

- Make suitable overseas secondment policy for domestic enterprises;

- Set up efficient incentive mechanism to motivate outbound employees;

- Ensure host countries' tax compliance for outbound employees;

- Obtain host countries' working visa and other required working permits;

- Compliance with host countries' labour law and other relevant legislation requirements;

- Understand host countries' tax treaty, avoid permanent establishment risk.

Payroll Compliance Review

It is commonly agreed that the most challenging issue to handle payroll in China is that we have complex, ever changing regulatory environment and practices all the time. A normal payroll cycle will touch on different regulatory framework, including payroll disbursement regulations, employment related regulations, social securities regulations, PRC IIT regulations, and even PRC corporate income tax regulations and PRC accounting regulations. On the one hand, as a developing country, China is working hard to introduce new regulations and practices on a frequent basis. On the other hand, the authorities are strengthening its management and control through kinds of audits and inspections.

In order to be compliant with all those complex and ever changing regulations, we are helping our clients conduct payroll compliance review in relation to the following:

- Review HR policy, employment contract and staff handbook where necessary;

- Review monthly payroll calculations, social benefits contribution details, and IIT calculations;

- Review benefits and reimbursement policy and/or arrangement;

- Review IIT position for in-kind-benefits;

- Review IIT calculation for special payroll payments, such as annual bonus, severance pay, stock option incentive payments, etc.;

- Review IIT position for off-cycle payments, e.g., commercial insurance, free overseas trip for top sales, etc.

Realising your performance potential

Some organisations have alarmingly found themselves diverting more resources from their core business in order to stay compliant in increasingly complex environments and cope with growing operational needs. To help you stay focused on your core activities and achieve your business performance goals, we collaborate with our Corporate Services professionals to lower your compliance risk, increase operational efficiency and reduce cost in hiring in-house specialised staff.

Contact us